Sample Financial Plan

- What a Real Financial Plan Looks Like: Meet John and Lisa Smith

We know retirement planning can feel overwhelming—especially when you’re trying to make the right decisions for the next 30+ years. That’s why we believe you should know exactly what it’s like to work with a financial planner before you ever hire one.

Most people only go through this process once in their life. When it’s done right, it should give you a roadmap that lasts—one you don’t have to start over from scratch every few years. But it can be tough to visualize what that actually looks like.

To help bring it to life, we’ve put together a sample plan for a fictional couple, John and Lisa Smith. While every client’s situation is unique, this gives you a behind-the-scenes look at the type of work we do, the questions we ask, and the way we help you make confident decisions with your money.

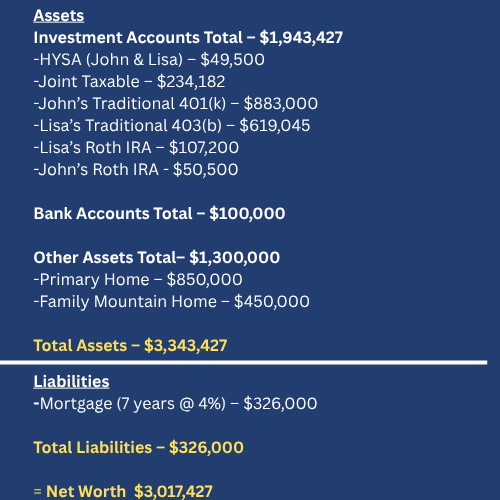

A Snapshot of John and Lisa’s Financial Life

Here’s a simplified look at their financial picture—this is the kind of high-level view we build early in the process to help everything start to click:

Balance Sheet Snapshot – John & Lisa Smith

How They Chose a Financial Planner

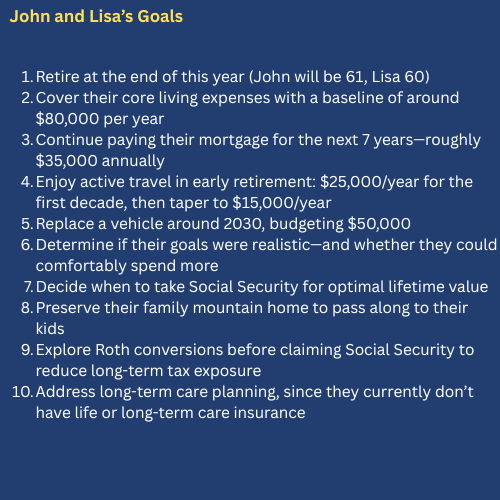

John and Lisa have done a great job managing their finances on their own. They’ve raised a family, stayed out of debt (aside from a manageable mortgage), and saved into multiple investment accounts over the years. But now that retirement is right around the corner, they wanted to be sure they were making the smartest decisions with what they’ve built.

After watching a video online about how sequence of returns risk can derail even the most disciplined retirement saver, they decided it was time to talk to someone. They didn’t want to just guess and hope for the best. They wanted a plan that gave them clarity.

They put together a list of must-haves for their financial planner:

- CERTIFIED FINANCIAL PLANNER™ professional—Someone with the credentials and training to cover all the angles, not just investments.

- Fee-Only Fiduciary—They wanted someone whose advice wasn’t influenced by commissions, and who was legally obligated to act in their best interest.

- Simple, transparent process—No hidden fees or complicated sales pitches.

That search led them to our firm, and they booked a free consultation.

The Initial Consultation

Here’s what John and Lisa’s experience looked like:

Their Free Assessment

John and Lisa started with a simple 3-step process designed to assess whether they were overpaying Uncle Sam, if there were any misalignments with their investments, and what a retirement income paycheck would look like today.

1. Discovery Meeting (45 minutes)

We spent the first 10–15 minutes confirming that their situation aligned with the type of planning we specialize in. Just like you wouldn’t see a knee specialist for a heart issue, we wanted to make sure we were the right fit for their needs.

From there, we shifted into learning more about them—their goals, their current financial picture, and what they want life to look like once they retire. We also explained how our process works and answered all their questions.

No prep work was needed. No statements or forms to fill out—just an open conversation.

2. Secure Document Upload

After that initial conversation, John and Lisa felt confident enough to take the next step. We sent over a secure link where they uploaded their most recent investment statements, tax returns, and pension/Social Security info. This gave us the real data we needed to assess their situation accurately.

3. Assessment Review Meeting (60 minutes)

In our follow-up meeting, we shared the results of their Free Assessment:

- What their monthly retirement paycheck might look like

- Whether their investments were aligned with their goals and income needs

- Where they could reduce taxes by avoiding common withdrawal missteps

They left that meeting with a much clearer view of where they stood—and what was possible.

There was no pressure to move forward. If they didn’t see the value, that would’ve been perfectly okay. But John and Lisa did see the value—and chose to continue down the path with us.

As a side note, we’re here to build long-term relationships. We do our best work with people who want an ongoing partner in their corner, not just a one-time project—someone to walk with them over the long run, helping adapt their plan as life, goals, and the market change, and to avoid costly DIY missteps along the way.

Planning Strategy & Risk Assessment

After completing their Free Assessment, John and Lisa decided to move forward and work with us on an ongoing basis under our investment management structure. From there, we got to work.

We entered their full financial picture into our key planning tools—RightCapital for building their retirement projections, Income Lab for optimizing guardrails and tax strategy, Riskalyze for portfolio risk analysis, Holistiplan for tax planning, and Wealth.com to modernize their estate plan.

We built two baseline retirement plans:

- A Monte Carlo analysis to measure the probability of success based on current inputs and assumptions.

- A guardrail-based plan using Income Lab to show how their spending could flex safely over time, depending on market performance.

Each of these plans served a different purpose. The Monte Carlo showed whether they were on track if nothing changed. The guardrail plan gave us a roadmap for adjusting spending up or down based on how their portfolio performs—without compromising their long-term goals.

We also modeled several withdrawal strategies and Roth conversion timelines in Income Lab to evaluate how different approaches would affect their long-term tax picture.

Next, we used Riskalyze to assess the level of risk in their existing investment portfolio.

John and Lisa’s current portfolio came back with a risk score of 60 out of 100, which helped explain their unease heading into retirement. Their risk-adjusted return score was 3.7 out of a possible 4.4—decent, but below optimal. Statistically, their portfolio had a 95% chance of swinging between -12.33% and +19.05% in any six-month period.

Their overall allocation was 57% stocks and 43% bonds and cash, producing an estimated long-term return of 6.66% annually with a 2.91% dividend and a relatively high expense ratio of 0.85%.

We then ran stress tests to see how their portfolio might hold up in different market conditions—like the bull run of 2013 or the downturn during the Great Financial Crisis (2007–2009). In that worst-case scenario, where the S&P 500 dropped 53.1%, their portfolio was projected to lose 39.3%, or about $763,000.

That result stopped them in their tracks. They hadn’t realized just how much risk they were still carrying this close to retirement.

We then ran a Monte Carlo simulation to see how they’d fare if they changed nothing. As part of this analysis, we tested what would happen if another Great Financial Crisis-level downturn occurred in their first year of retirement—resulting in a 39.3% loss. Unfortunately, their chances of success came back at just 43%, well below the 80% benchmark we aim for.

Of course, they could sell their family mountain home to free up funds—but one of their goals was to preserve that for their children. So instead, we looked at how to improve their plan without giving up any of their core goals.

We explained there were three key levers we could adjust:

- A smarter, retirement-specific investment allocation

- Better timing around Social Security and pension income

- And a coordinated, tax-aware withdrawal strategy

The first step was redesigning their investment mix. We created a custom portfolio that aligned with their income timeline and risk capacity. Their risk score dropped from 60 to 43, and their revised risk-adjusted return score rose from 3.7 to 4.4. Their expense ratio also fell from 0.85% to 0.25%, and if another major downturn happened, the expected loss would be $592,000 instead of $763,000.

Just this one adjustment raised their Monte Carlo success rate from 43% to 91%. That gave them the flexibility to increase their base retirement spending from $80,000 to $86,000 per year and still remain on track.

With their investment risk realigned and guardrails established, we turned our focus to the next set of planning levers: Social Security, tax strategy, and income distribution. These three areas are often overlooked—but when coordinated properly, they can add hundreds of thousands of dollars in value over a retirement.

Social Security Optimization

We used a Social Security analysis based on the Smiths’ current ages—John at 61 and Lisa at 60—and assumed average life expectancies of 81 and 84. Based on this, our recommendation was:

- Lisa to file at age 65 and 6 months

- John to file at age 69 and 11 months

This staggered approach allows them to maximize household benefits and increase Lisa’s survivor benefit down the road.

However, we also ran multiple scenarios in RightCapital’s Social Security Optimizer and tested them through Monte Carlo analysis. One surprising insight: if both live to age 95, John filing at his full retirement age and Lisa at age 62 gave them the best chance of success. This option aligned more closely with their personal preferences to begin benefits earlier—especially since Lisa preferred to stop working soon.

We emphasized one critical point: when one spouse passes away, only the higher benefit remains. That’s why we encouraged delaying at least one benefit to maximize the survivor income, and they agreed with this strategy.

Tax Planning & Roth Conversion Strategy

Next, we reviewed the Smiths’ current and projected tax brackets and explored ways to minimize their lifetime tax burden—not just their taxes in the current year.

We modeled two withdrawal strategies:

- A traditional “no-Roth” sequence (tax-deferred → taxable → tax-free)

- A Roth conversion approach, staying under the Medicare IRMAA Tier 1 threshold

Here’s what we found:

- If they pull solely from taxable and tax-deferred accounts, their average effective tax rate stays manageable—but their total tax paid is higher, especially in later years.

- By converting $40,000–$60,000 per year from John’s IRA to a Roth IRA from 2026 to 2030, they reduce:

- Their future tax rate by ~4%

- Their total lifetime tax bill by nearly $500,000

- Their Medicare premium risk in retirement

- It also increases their net estate value by roughly $500,000 in future dollars.

With this strategy, their breakeven point for the tax savings is around age 82/80, but if tax rates rise in the future (as they believe they will), the breakeven happens much earlier.

We also showed how this strategy fits within their Income Lab guardrails—ensuring their withdrawals stay safe and sustainable throughout all market environments.

Cash Flow Insights & Guardrail Testing

With their total investable assets projected to be $2.07M at retirement, Income Lab calculates that they can safely spend $11,692/month, covering their base spending, mortgage, and travel goals.

If the market does well and their portfolio grows to $3M+, they’ll be able to increase spending to $16,941/month.

If we hit a downturn similar to the 2008 financial crisis (a ~22% drop), their spending floor adjusts to around $10,700/month—still enough to meet their core lifestyle goals without selling key assets like their mountain home.

We also encouraged John and Lisa to take advantage of the Backdoor Roth IRA strategy while they still have earned income. This lets them add tax-free growth to their plan at no additional tax cost today, maximizing retirement flexibility down the road.

Estate Planning

Finally, we recommended they revisit their estate documents using our preferred platform, Wealth.com. Their current wills were over 10 years old, and we encouraged:

• Updating wills and living trusts

• Adding health care directives and powers of attorney

• Reviewing all beneficiary designations to ensure alignment with their legacy wishes

We also offered to guide them through funding any new trusts and titling investment accounts properly to avoid probate.

Healthcare Planning: Pre-65 and Beyond with MOVE Health

Since John and Lisa are retiring before age 65, a major piece of our planning centered around how to bridge the gap to Medicare without overspending or leaving themselves underinsured.

We explored a variety of pre-Medicare options with our partner MOVE Health, including:

• Marketplace Insurance Plans (ACA): We reviewed their eligibility for premium subsidies, which may be surprisingly generous in early retirement due to their lower taxable income from strategic withdrawals.

• Medi-Share and Christian Health Ministries: As alternatives to traditional insurance, we discussed faith-based healthcare sharing ministries, which can lower monthly costs—but come with tradeoffs in coverage consistency and provider flexibility.

• COBRA: We reviewed whether extending coverage from John’s employer plan was worthwhile or too expensive based on their expected income and health needs.

• Short-term gap coverage: We modeled what it would look like to use flexible short-term health plans as a low-cost option during any transitions.

When they turn 65, we’ll coordinate with our trusted partner, Move Health, to walk them through:

• Medicare Parts A, B, D, and supplemental options

• Whether to pursue a Medigap plan vs. Medicare Advantage

• Avoiding IRMAA surcharges by aligning income levels with tax strategy

For now, we’ve built their healthcare premiums and expected out-of-pocket expenses directly into their financial plan, with flexibility to adjust as their needs change or new legislation shifts ACA subsidy rules.

Insurance & Risk Management with BC Brokerage

As part of their retirement planning, John and Lisa wanted to know if they were exposed to any financial risks they hadn’t considered—especially now that they’re no longer earning income.

We partnered with BC Brokerage, a trusted independent insurance firm, to walk through key areas:

• Long-Term Care: With over $2 million in investable assets, John and Lisa could potentially self-insure this risk. But we still stress-tested their plan using both scenarios—with and without long-term care costs—to see how each would affect their legacy and ongoing income needs. We’re currently exploring hybrid policies that would provide benefits if needed, but return value to their estate if not used.

• Life Insurance: Their existing term policies are nearing the end of their coverage period. Since they’ve largely met their financial independence goals, we discussed whether maintaining life insurance still serves a purpose. In their case, it might make more sense to shift the focus toward legacy planning, possibly using a permanent policy funded through tax-efficient strategies like Roth conversions or gifting.

• Disability Insurance: Not applicable for their situation anymore, given that both are exiting the workforce by year-end. We confirmed there are no lingering premium payments or automatic renewals.

Rather than automatically buying coverage, this part of the plan is about decision-making with eyes wide open. We’ll continue to revisit these conversations, especially as healthcare, family needs, or tax laws evolve.

Plan Implementation

With their strategy mapped out, John and Lisa Smith moved into the implementation phase. Together, we reviewed each of the action steps outlined in their planning dashboard, prioritized the most urgent tasks, and set realistic deadlines. I made sure everything was organized in one place so they could always reference their plan.

We scheduled their first biannual review for six months out and confirmed they could reach me at any time in between for questions, unexpected life changes, or additional support. It’s important that clients like John and Lisa know they’re never on their own.

We also began handling the transition of their investment accounts, collaborating with Charles Schwab to ensure a smooth transfer and proper investment alignment. As we coordinated with MOVE Health for healthcare options and BC Brokerage for evaluating long-term care and insurance strategies, we also helped initiate updates to their estate plan through Wealth.com.

Ongoing Plan Maintenance

With their financial plan in motion, John and Lisa now benefit from ongoing support in five key areas:

Investment Strategy Execution - We manage their investments using a bucket strategy tailored to their income needs, timeline, and risk profile. Portfolios are reviewed for rebalancing opportunities, low-cost fund changes, and tax efficiencies.

Tax Planning - Ongoing tax planning ensures that income is pulled from the right accounts, in the right order, at the right time. We also evaluate Roth conversion opportunities annually.

Income Planning - Each year, we review their “retirement paycheck” setup to confirm cash flow remains reliable, tax-efficient, and aligned with current spending needs.

Biannual Check-Ins - We meet twice per year to revisit their goals, update assumptions, and adapt to any life or market changes. These meetings allow us to stay on track without overwhelming their schedule.

On-Demand Support - In addition to scheduled meetings, John and Lisa have unlimited access to me throughout the year. Whether it’s a life event, a tax question, or just wanting reassurance—we’re here.

By walking through this thoughtful, multi-phase process, John and Lisa gained a clear understanding of their options, their path forward, and the ongoing support they’ll receive. They left our meetings feeling more confident, more organized, and more secure about their financial future.

If you’re ready to explore your own retirement path and want to know what’s possible, schedule a free, no-obligation consultation. I’ll help you assess where you are, what’s working, and what adjustments can help you move forward with clarity.